Final Expense Life Insurance

Final Expense Insurance

protects your loved ones from the burden of your final end-of-life expenses.

Watch the video above and schedule a consultation with Bret using the calendar below.

Life Insurance The Way It Should Be.

"At Bunich Family Insurance, our mission is to empower individuals and families to achieve financial security and prosperity through tailored Index Universal Life Insurance and Final Expense Life Insurance solutions.

We are committed to providing our clients with innovative, flexible insurance products that not only safeguard their future but also contribute to their financial growth.

By prioritizing transparency, integrity, and personalized service, we strive to build lasting relationships with our clients, helping them navigate life's uncertainties with confidence.

Our goal is to create a harmonious balance between protection and investment, enabling our clients to live their lives to the fullest with peace of mind and financial well-being."

Index Universal Life Insurance

Index Universal Life Insurance (IUL) is a type of permanent life insurance that offers both a death benefit and a cash value component. What sets IUL apart from other life insurance policies is the way the cash value can grow.

Final Expense Life Insurance

Final Expense Insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance designed to cover the expenses that your loved ones will face after your death—such as funeral expenses, burial costs, any final medical bills, etc.

Meet Our Team

Bret Bunich

Advisor

Niki Bunich

Admin

Brian Venuto

Advisor

Ticiane Vieira

Advisor

Frequently Asked Questions

What is Index Universal Life Insurance?

Index Universal Life Insurance (IUL) is a type of permanent life insurance policy that offers both a death benefit and a cash value component. What sets IUL apart from other life insurance policies is the way the cash value can grow:

Interest Crediting Linked to an Index: The cash value's growth is tied to a stock market index, like the S&P 500. Instead of a fixed interest rate, it earns based on the performance of this index, subject to certain caps and floors. This means there's a maximum cap rate on the returns your cash value can earn, as well as a floor that protects against losses in a down market, so you won't lose cash value if the index performs negatively.

Flexibility: IUL policies offer flexibility in premium payments and death benefits. You can adjust the premiums within certain limits and also have some say in the death benefit amount, provided you pass underwriting criteria.

Tax Benefits: The policy’s cash value grows on a tax-deferred basis, and policyholders can take out loans or make withdrawals from the cash value without paying taxes (as long as the policy is not surrendered or lapsed).

Use for Financial Planning: Policyholders can use the cash value for retirement income, education expenses, or other financial needs just to name a few. The cash value is yours to do what you want/need to with.

IULs are complex products. They are often presented as a vehicle for investment as well as life insurance coverage, and the suitability of an IUL policy can depend on individual financial situations, goals, and health.

What is Final Expense Insurance?

Final Expense Insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance designed to cover the bills that your loved ones will face after your death—such as funeral expenses, burial costs, any final medical bills or even just to leave a legacy.

Here are some key features:

Low Coverage Amounts: Unlike traditional life insurance policies that offer high coverage, final expense policies typically provide a smaller benefit, usually ranging from $2,000 to $50,000, since they're intended to cover only specific end-of-life expenses.

Simplified Issue: Most final expense insurance policies do not require a medical exam to qualify; they often only require answers to health questions that are read to you by your advisor.

Fixed Premiums: The premiums are generally fixed over the life of the policy, meaning they do not increase as you age.

Cash Value: Like other whole life policies, final expense policies can accumulate a cash value over time, which the policyholder can borrow against if needed.

Permanent Coverage: As long as premiums are paid, final expense insurance lasts for the lifetime of the policyholder and does not expire after a term.

Quick Payout: Because the benefit amount is typically smaller than traditional life insurance, these policies can often pay out quickly to cover immediate expenses.

This insurance is especially popular among seniors who want to ensure that their final expenses are not a burden to their families or loved ones.

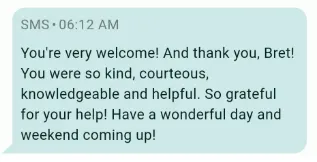

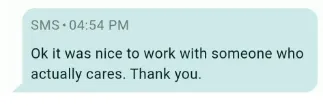

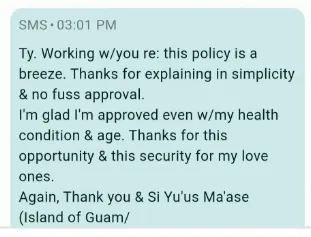

SOME OF OUR TESTIMONIALS

What they’re saying about

our company

Bret Bunich

Advisor

Brian Venuto

Advisor

Ticiane Vieira

Advisor

Contact Information:

Email: [email protected]

Address:

Perfect Balance Life Insurance is a nation wide agency with our home office based in Seattle, WA

Get In Touch

Assistance Hours

Mon – Sat 8:00am – 8:00pm

Sunday – CLOSED

Phone Number:

(206) 309-8111